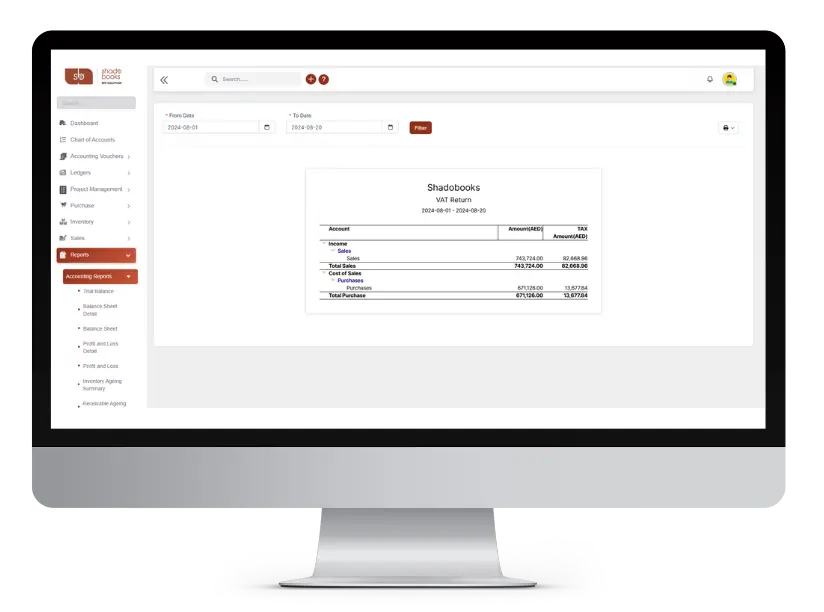

Never Overpay on Taxes Again

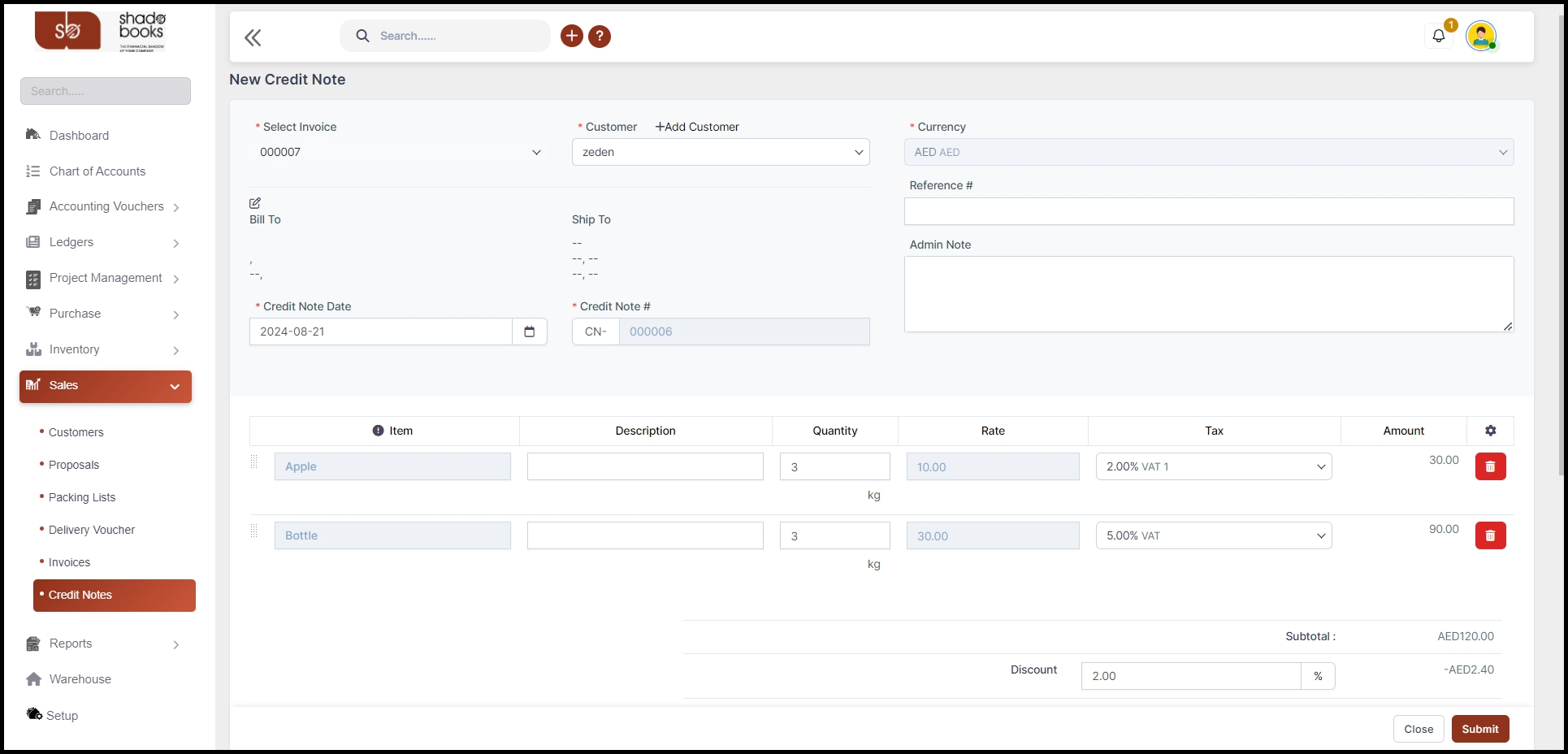

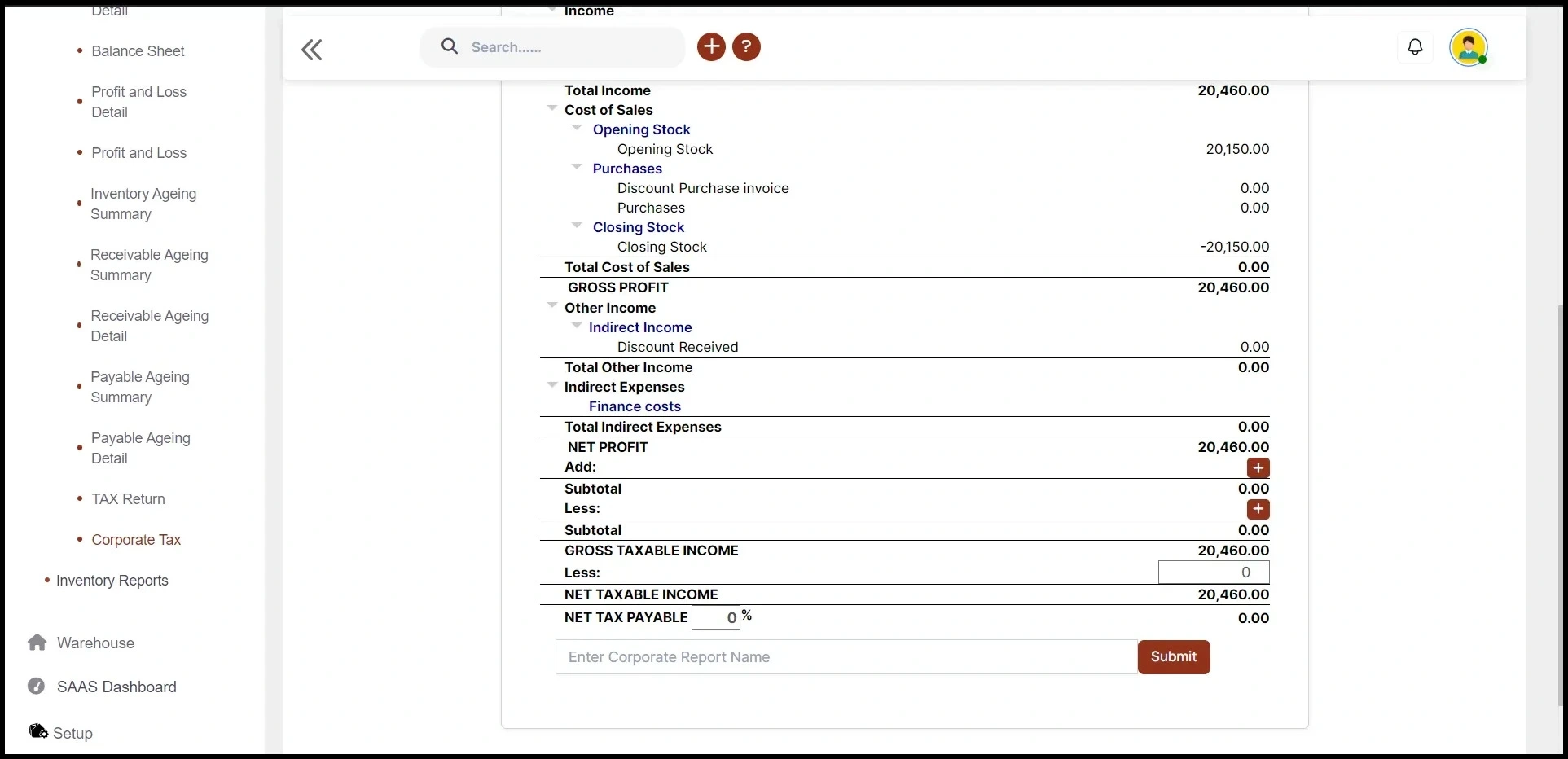

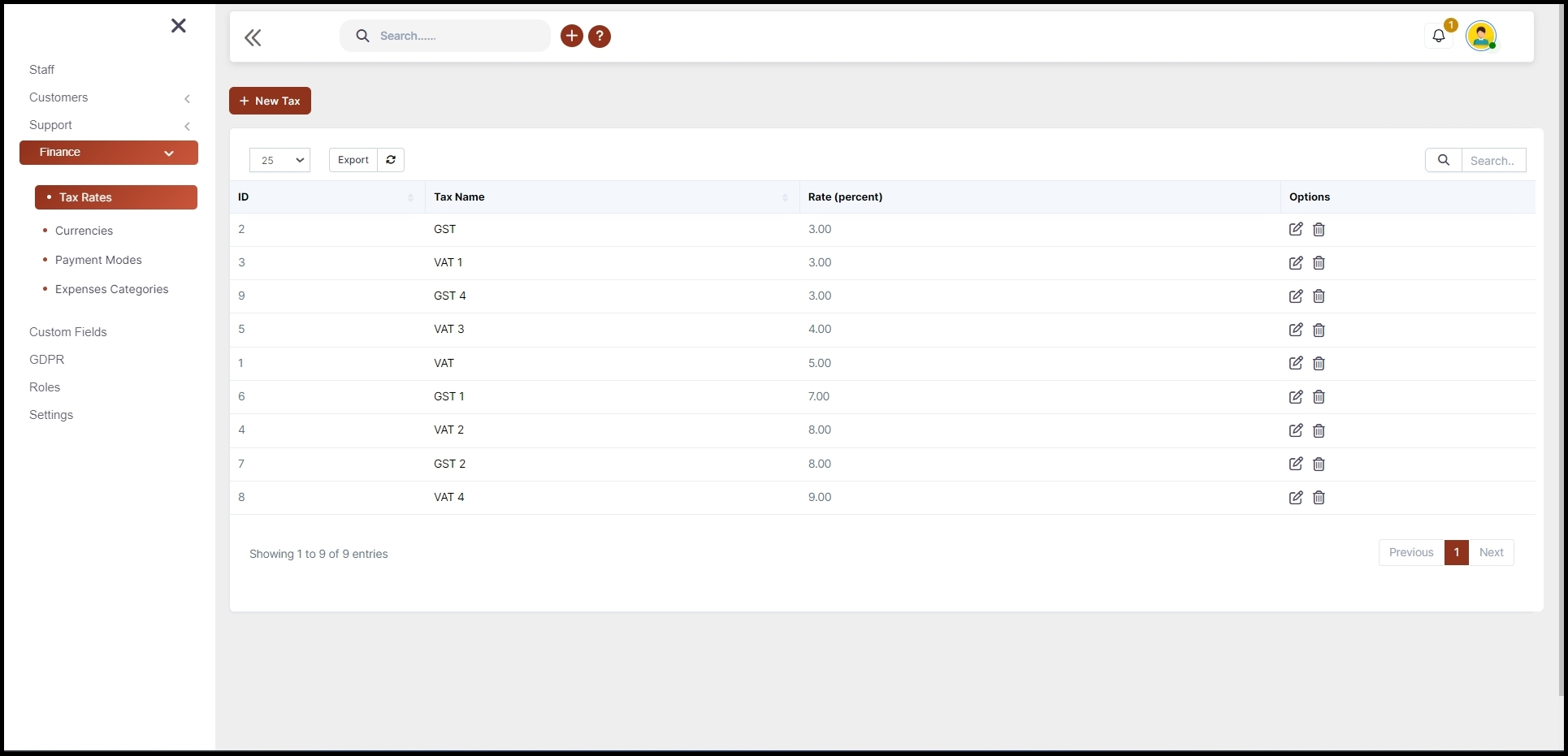

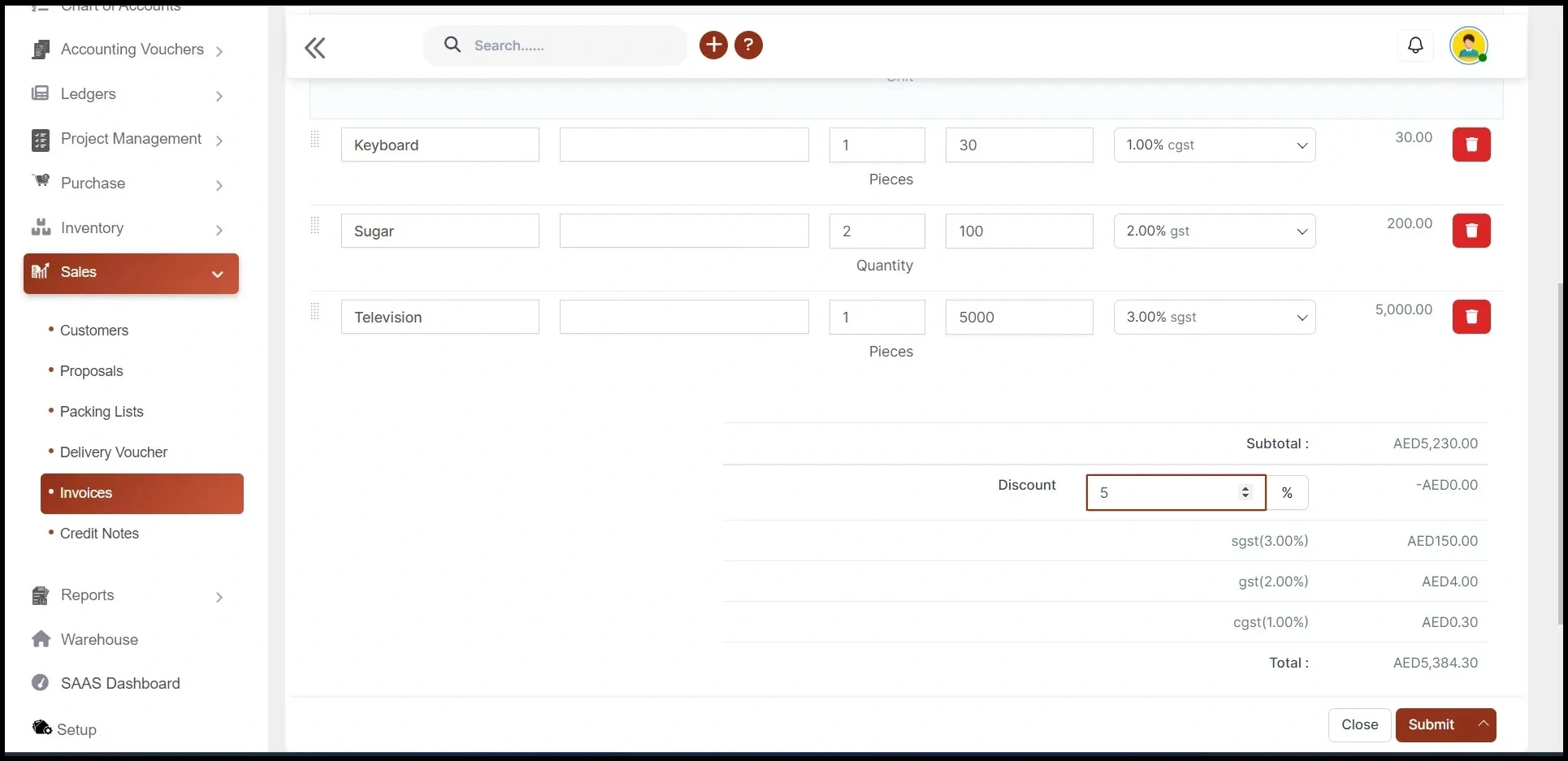

Say goodbye to the days of flipping through complex spreadsheets and manually calculating sales tax. With Shadobook's tax accounting software in UAE, it’s easy to create customized tax rates for invoices, vouchers, purchase orders and more, that fit your specific business needs.

Chat Now