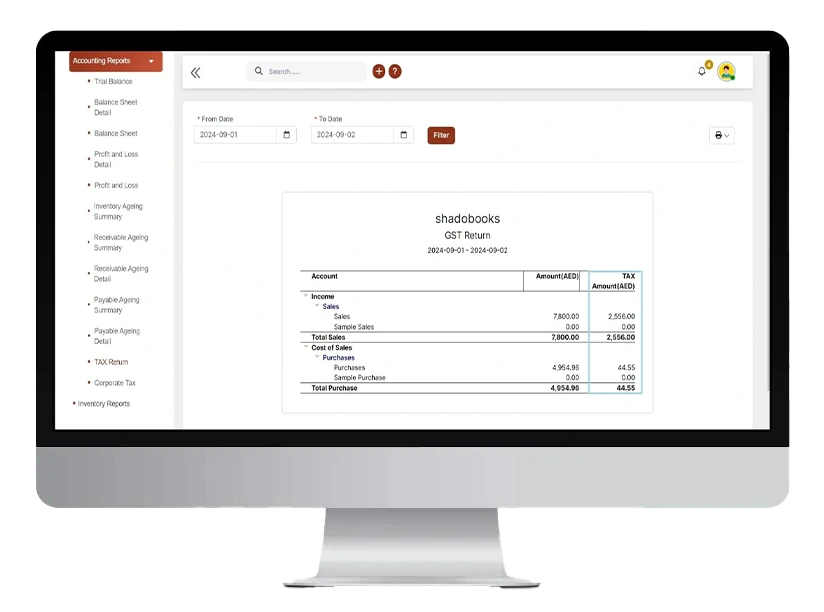

Maximize Savings with Accurate GST Filing

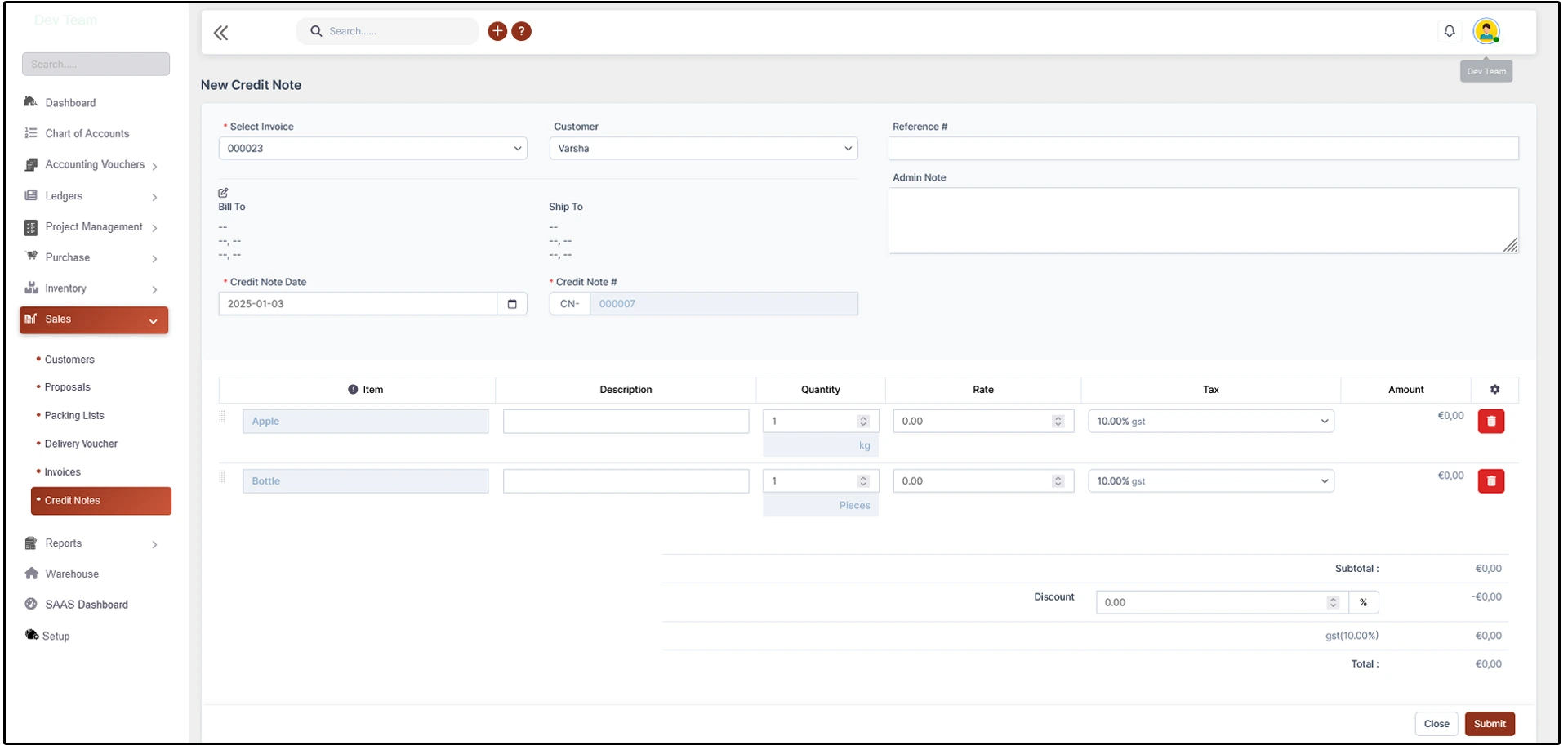

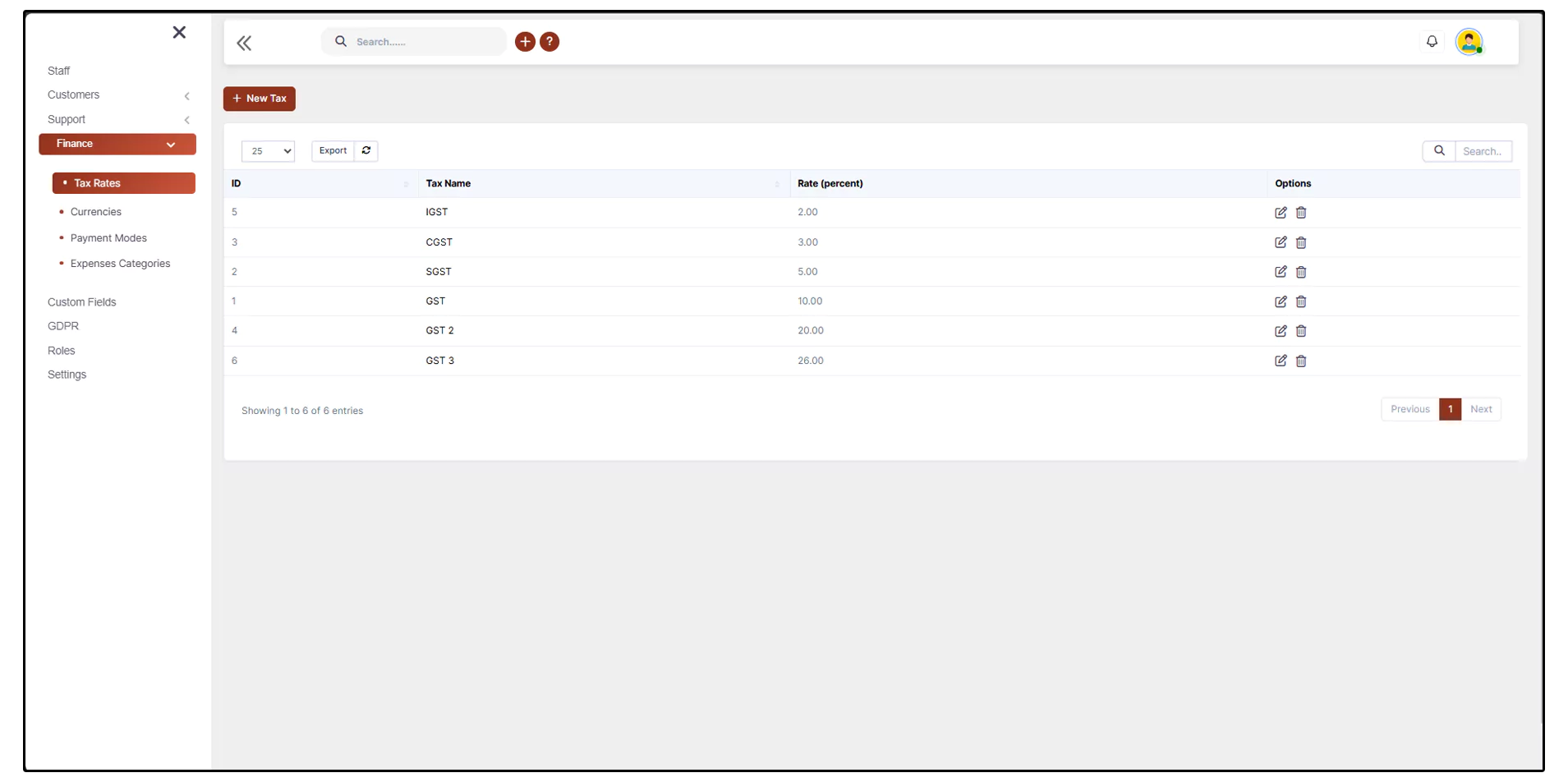

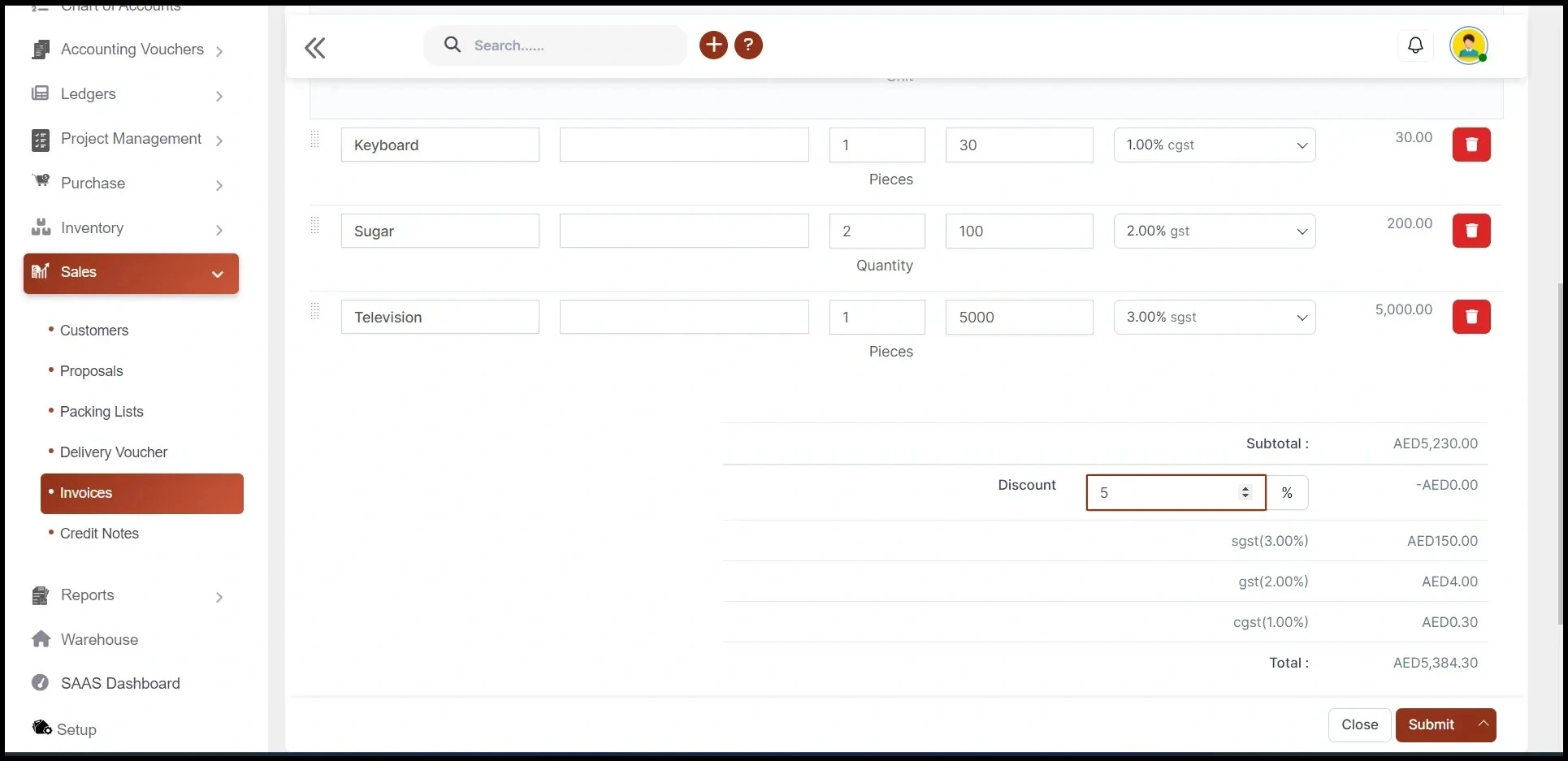

Managing GST compliance has never been easier! Shadobooks Software simplifies GST filing and ensures accuracy with automated tax calculations, real-time reporting, and seamless integration with your accounting processes.

Chat Now