Work Smarter, Not Harder with Shadobook’s Invoicing Software

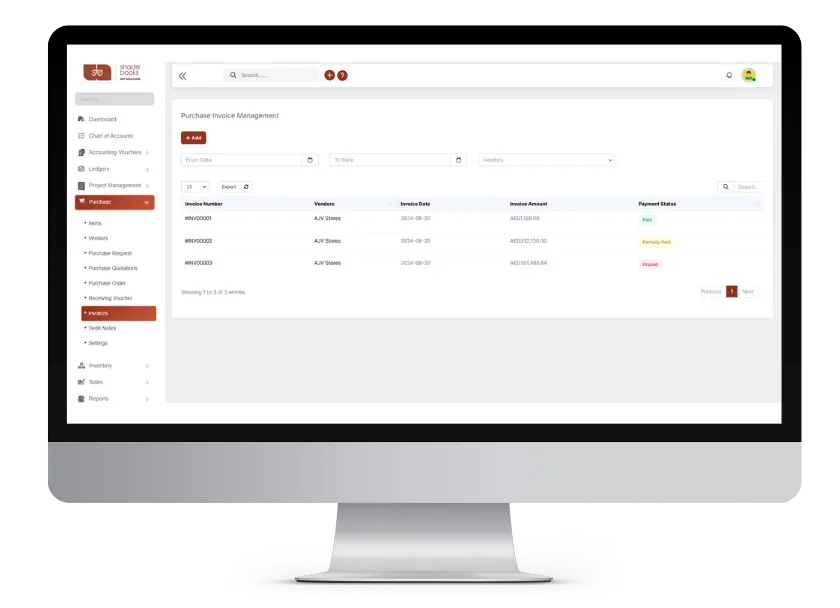

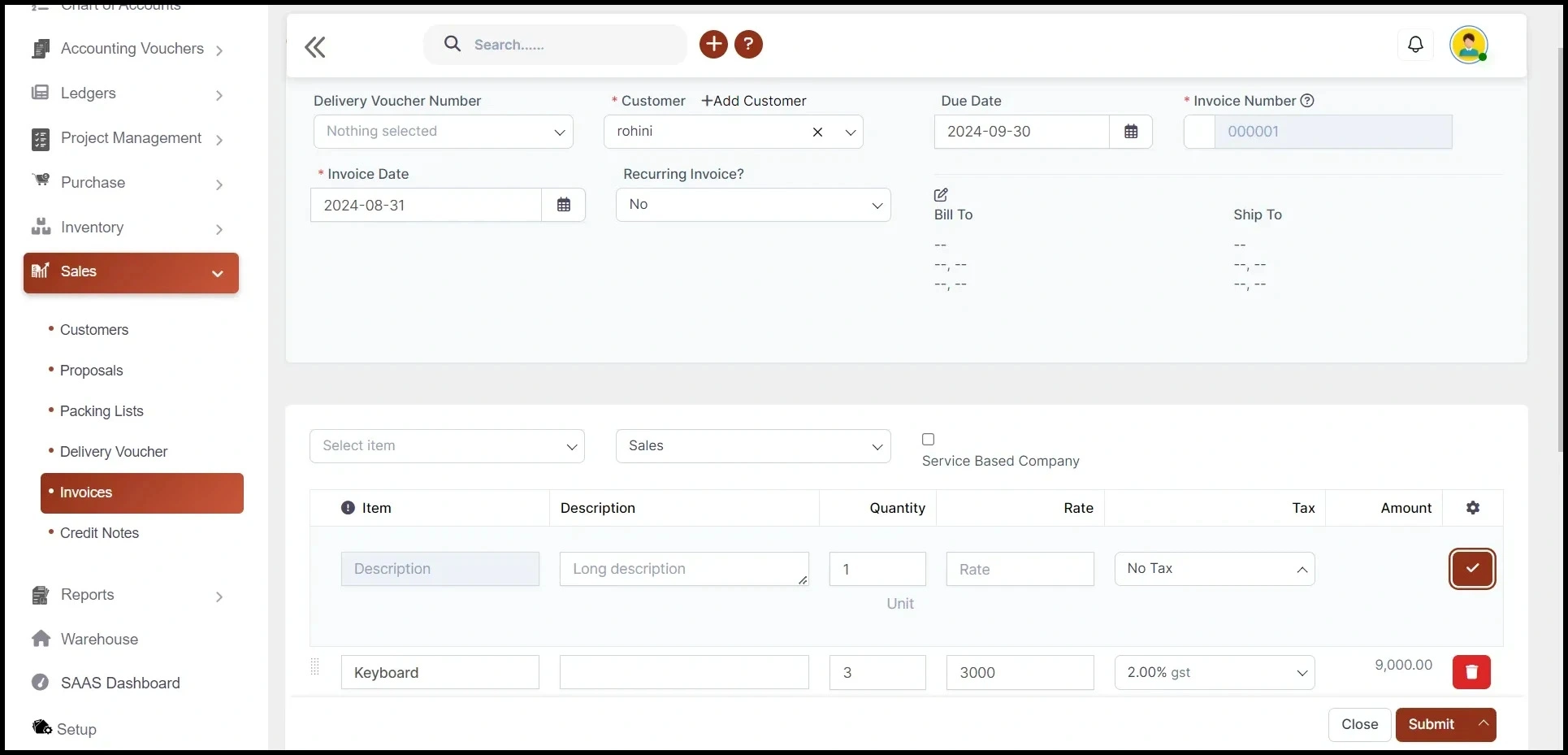

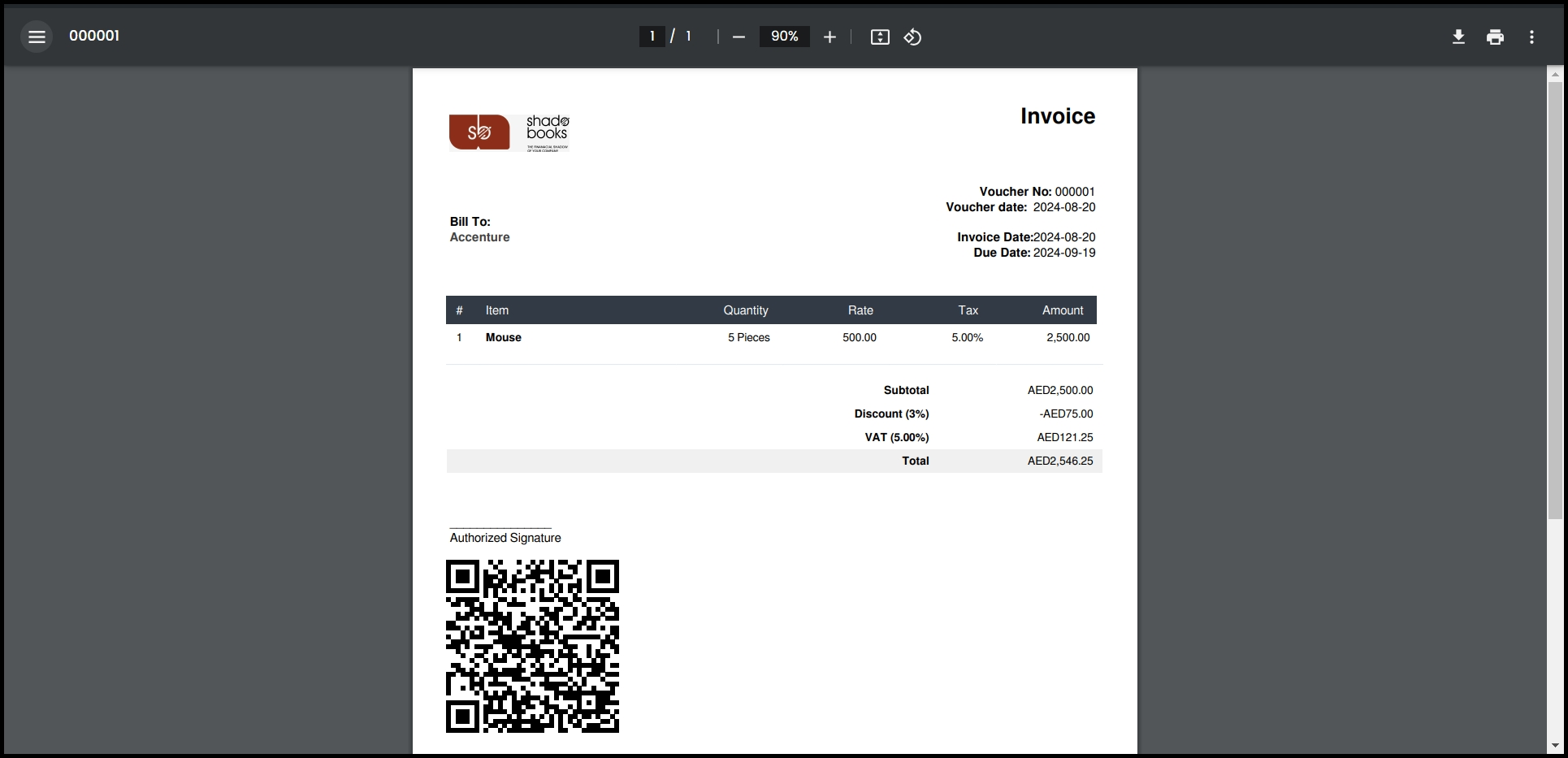

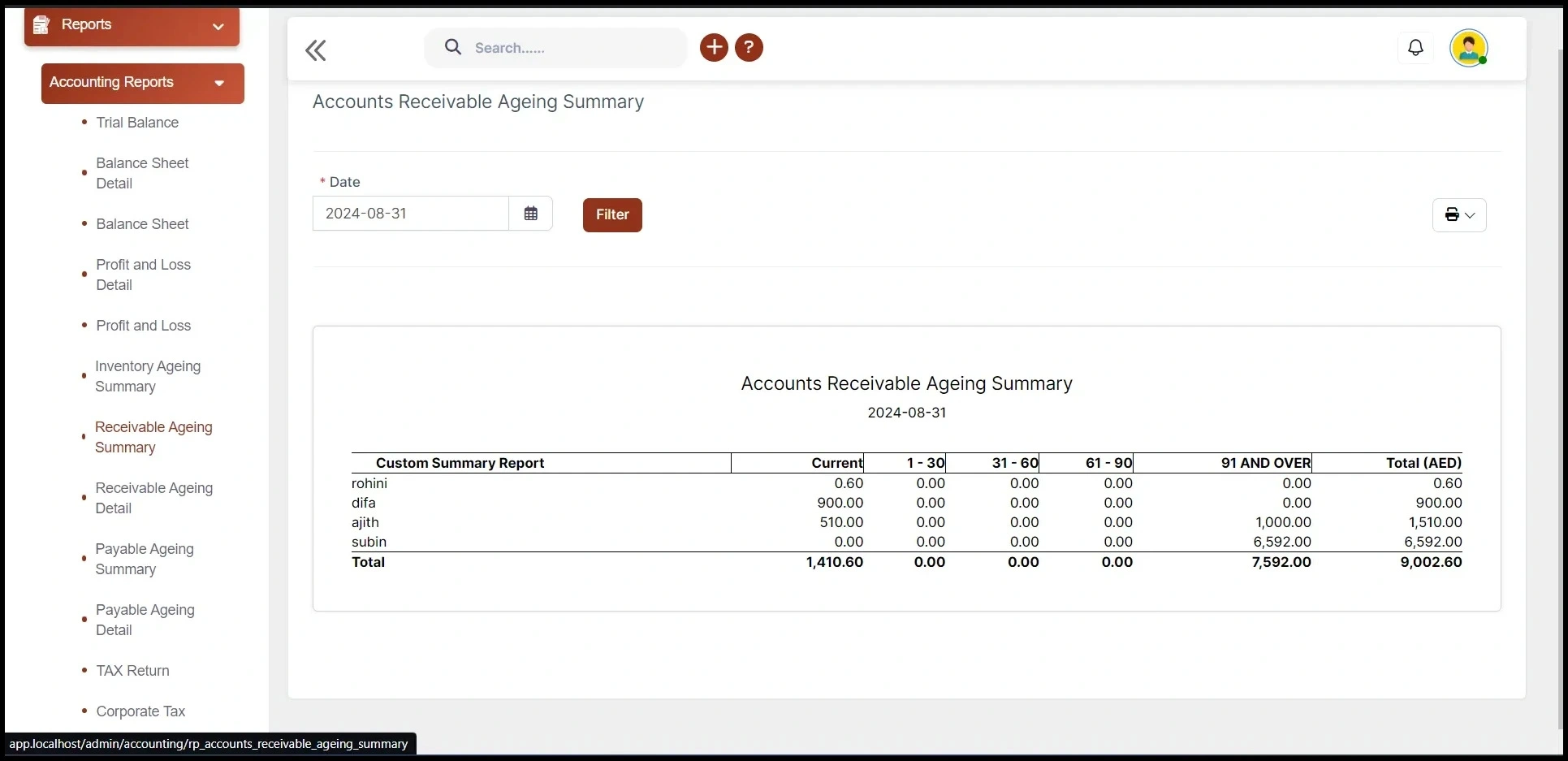

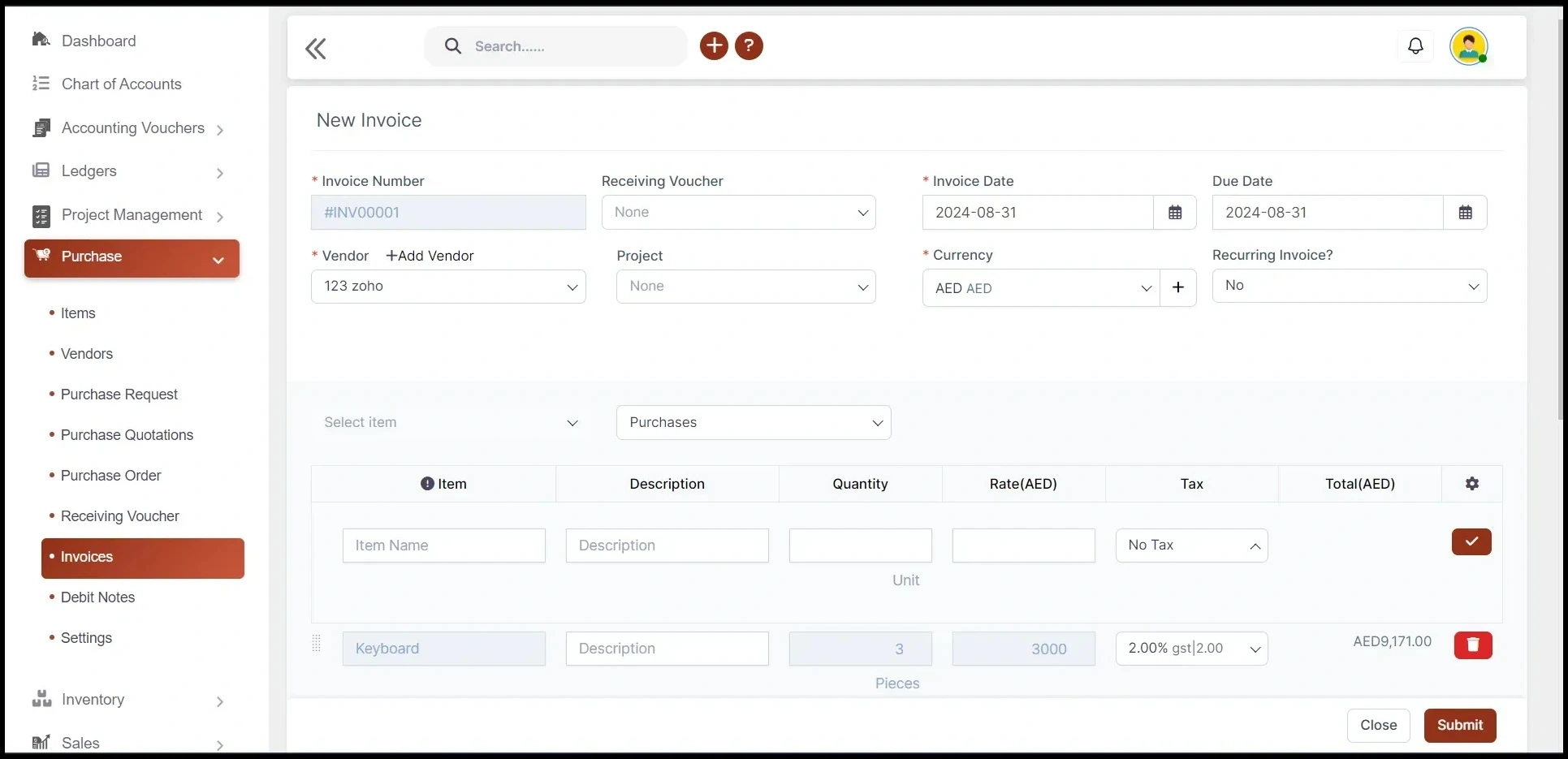

Managing invoices can feel overwhelming, especially for small business owners juggling multiple responsibilities. Our online invoicing software in UAE offered makes this process as efficient. Imagine sending invoices for sales and purchases with just a few clicks, eliminating manual errors, and staying on top of payment statuses.

Chat Now